BIC Process Design

Understand & Transform

Supercharge your business operations with the most intuitive AI-powered BPM software.

It seems that you come from a German speaking country. Here you can change the language

English

As an industrial insurer, MSIG Insurance Europe AG (MSIGEU) is bound by BaFin and other requirements in the areas of property, marine/cargo, liability and technical insurance. With BIC Platform, MSIGEU has created an audit-proof process management system whose process architecture adapts adaptively to new requirements.

"As an insurance company, the trust of our customers is our most valuable asset. For this very reason, we need a platform for our business processes and risk management that we can trust. Shortly after our establishment as a European subsidiary of the MS&AD Group in 2012, we implemented BPM to meet national and international requirements securely and efficiently. Since then, we have relied on GBTEC's software solutions. Together, we are constantly thinking process management further and integrating new functions such as GRC workflows and BIC Process Execution for process execution. This pays off, because with BIC Platform our employees have exactly one point of contact to keep track of the processes that are important to them."

Michael Mies

Head of Business Organization

MSIG Insurance Europe AG

MSIG Insurance Europe AG

Headquarters: Cologne, Germany

Employees: 360+

Industry: Finance & Insurance

BIC Platform modules in use:

BIC Process Design

BIC GRC

BIC Process Execution

From the very beginning, MSIGEU has relied on BPM and anchored it in the company as an evolutionary process. BIC Platform is the basis for efficient processes and audit-proof risk management at the industrial insurer.

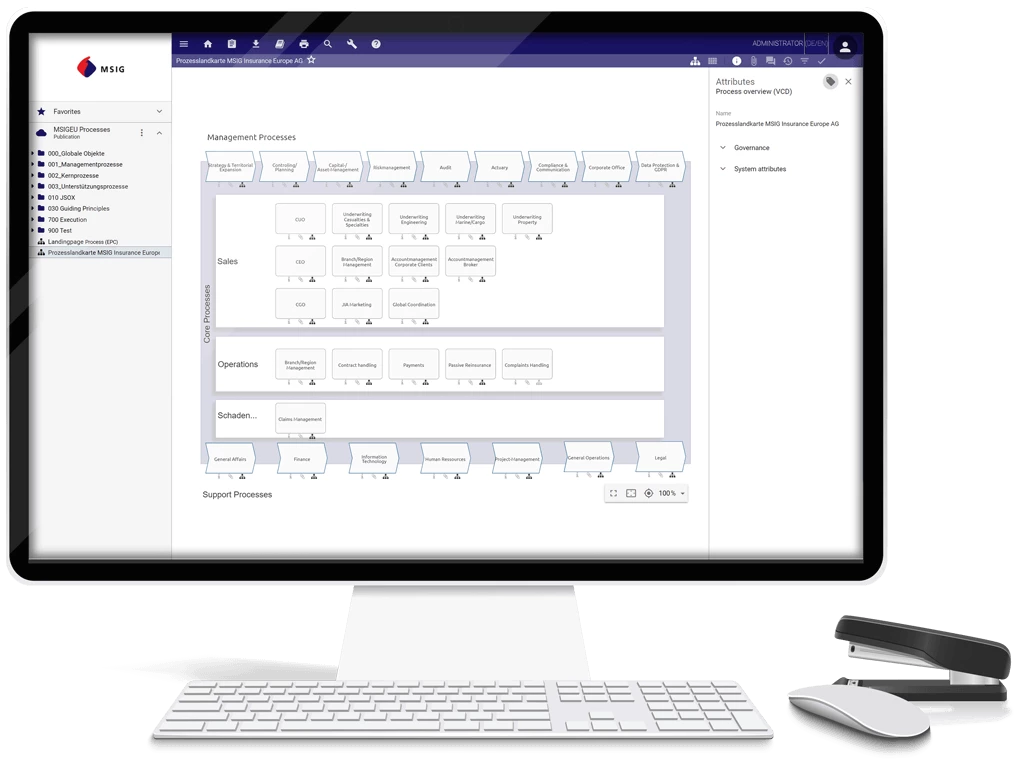

Over 500 modeled management, core

and support processes safeguard the business

Stable process landscape, flexible and adaptive detail processes

BaFin requirements effectively implemented

From BPM to GRC with action management

Watch the video to learn how industrial insurer MSIGEU uses BIC Platform to ensure operational resilience of complex and highly regulated insurance processes.

The Japanese insurer Mitsui Sumitomo Insurance Company Ltd. has been active in Europe for more than 40 years. In 2012, the group decided to establish MSIGEU, based in Cologne, Germany. MSIGEU has since assumed responsibility for the group's business in continental Europe. The previously decentrally organized process documentation was to be controlled via a central management. In order to be able to analyze the existing structures and processes in a meaningful way, the company decided at an early stage to set up a process management system. In addition to standardization, the specifications of the various insurance sectors were to be taken into account. As an industrial insurer based in Germany, MSIGEU is also bound by the regulations of BaFin. In the regulatory Minimum requirements for the business organization of insurance undertakings (MaGo), it requires that written guidelines must at least "cover business processes that are subject to material risks." MSIGEU wanted to anchor this requirement for its core processes with the help of a comprehensive process landscape for its risk management and other management functions.

For the adequate control of their processes with embedded risks, MSIGEU was looking for a modern BPM solution that allows intuitive modeling according to best practices. They also wanted a long-term partner that would support the development and maintenance of a sustainable process landscape with its IT solutions, services and associated consulting. In GBTEC, the industrial insurer found a partner who could also offer a convincing price-performance ratio. In setting up the process management, the company drew on the knowledge of its employees: Interviews with the individual departments helped to capture the relevant activities as work processes and to exploit potential for improvement. In the process, the modelers enriched as much information as possible and linked processes - where feasible - directly to associated documents and systems from enterprise architecture management (EAM). In this way, it was possible to build a stable process map whose in-depth processes are nevertheless adaptable to the specific requirements of the individual business units. The automatic resubmission as well as the regulated release and review workflows in BIC Platform support MSIGEU in continuously scrutinizing, optimizing and keeping processes up to date.

With BIC Platform, the industrial insurer has built a highly integrated IT system that efficiently implements the regulatory requirements for process management in the insurance industry. The BPM suite serves as a central point of contact for the teams, which receive training on process management in regular events. The process organization is described with the help of a comprehensive process map with over 500 individual models that depict activities as well as their associated risks and controls. With the connection of process management to the workflow-supported GRC management in BIC GRC, the management benefits additionally from

MSIGEU uses its process management to record interfaces in the company and create efficient processes in the business flow. In this way, the company and its customers benefit equally and a future-proof process landscape has been created.

MSIG Insurance Europe AG (MSIGEU) is a continental European insurer headquartered in Cologne, Germany. In 2012, MSIGEU was established as a wholly owned subsidiary of Mitsui Sumitomo Insurance Company Ltd. (Japan). As a result, it is part of the MS&AD Group, which is one of the largest insurance groups in the world. Since its foundation, MSIGEU has become an established insurance company in the European market. MSIGEU offers insurance coverage in the following lines: Liability Insurance (including D&O), Property Insurance, Technical Insurance and Marine/Cargo Insurance.

Hochschule Ravensburg-Weingarten:

Process-based quality management with BIC Platform

KOSTAL:

KOSTAL upgrades its process management to global quality management