BIC Process Design

Understand & Transform

Supercharge your business operations with the most intuitive AI-powered BPM software.

It seems that you come from a German speaking country. Here you can change the language

EnglishClosely aligning all areas of governance, risk, and compliance (GRC) helps companies stay on top of risks, meet regulations, and build long-term resilience. With Integrated Risk Management (IRM), these processes come together on one central platform – making them easier to manage, more efficient, and scalable as your business grows.

Table of contents

Author

Sandra Blaha

To understand what Integrated Risk Management (IRM) is, it’s helpful to know what it’s not and how it differs from less modern practices.

Traditional risk management often works in silos – each department handling risks separately, which can lead to blind spots and inefficiencies. This fragmented approach makes it difficult to see the full risk landscape and as a result, businesses may struggle to anticipate threats, respond adequately, or stay compliant with changing policies and regulations.

In contrast, IRM uses a different strategy by bringing governance, risk, and compliance (GRC) together on one, unified platform. It’s commonly underpinned by a structured risk management framework (RMF) that combines different risk management activities and helps organizations identify, assess, and mitigate risks across all business areas.

Whether it's cybersecurity threats, financial uncertainties, or operational disruptions, a strong IRM enables businesses to manage risks comprehensively and focus on strategic objectives and growth.

Integrated risk management takes into account that risks usually don’t occur in isolation but are often interdependent and thus part of a larger context. For this reason, it makes sense to view risk management as a multidisciplinary task and to link key GRC areas such as enterprise risk, internal control, business continuity, internal audit, data protection, information security, and compliance. This way, risks can always be assessed in their full context, allowing for more effective and efficient management.

Today, this approach also includes sustainability and ESG management, which are becoming increasingly important worldwide due to growing environmental awareness, green initiatives, and a stronger focus on corporate social responsibility. By taking this integrated perspective, companies not only enhance their resilience but also build a strong risk culture that runs through all business areas.

Regardless of what kind of risks we’re talking about – whether enterprise, privacy, information security, process, or sustainability risks – integrated risk management is a full-circle approach that includes all stages of the risk management lifecycle, from devising a comprehensive risk strategy to ongoing improvements:

Building a risk management framework that aligns with business objectives, regulatory requirements, and industry best practices. Ideally, clear roles and responsibilities are assigned from the start to ensure smooth risk handling.

Identifying potential risks across all business areas and assessing their likelihood and impact. Assessment methods can be either qualitative or quantitative, using simulations and data projections.

Developing and implementing proactive and tailored strategies to avoid, reduce, transfer, or accept risks. Potential measures may include process changes, security controls, or contingency plans to minimize exposure.

Using real-time data, risk tracking techniques, and regular audits to detect changes in risk levels. This way, organizations can achieve compliance with evolving regulations and address threats before they turn into events.

Having a clear protocol in place for responding to risk-related incidents. The goal is to be able to take quick action to contain and resolve incidents so that business disruptions and financial or reputational damage are avoided.

Maintaining a centralized repository to document risks, actions taken, and the effectiveness of measures. Transparent reporting, including key metrics and lessons learned, helps improve future risk strategies.

Organizations that implement Integrated Risk Management (IRM) experience a whole host of advantages. To highlight the most important ones, here’s a condensed list of the primary benefits companies can expect:

In general, the larger an organization, the more global its operations, and the more complex its supply chain, the more important it is to have a well-integrated risk management solution as it helps close blind spots, uncover hidden risks, and provide a clear picture of the overall risk portfolio. This is especially true for medium-sized and large enterprises, where risks are widespread and multifaceted. Industries such as finance, energy, healthcare, and other critical sectors that are considered essential to society face particularly strict regulations, making a strong risk management framework not just beneficial but legally required. Without such a framework, businesses expose themselves to serious consequences:

Cyberattacks, supply chain disruptions, or regulatory fines can quickly accumulate into significant and far-reaching business threats with potentially cascading effects. If such risks are insufficiently managed, poorly assessed, or left unattended, severe financial setbacks may be the result, including costly crisis management and even long-term operational instability.

Data breaches, environmental violations, or ethical missteps – if ignored or left unnoticed – can spiral out of control much faster than any business would be able to keep up. Without a quick and effective response through integrated risk management, these risks can escalate into full-blown crises, hurt your reputation, and ultimately cost you the hard-earned trust of customers and investors.

In the EU, regulations like NIS2, DORA, and CSRD are a hot topic – and for many businesses, compliance isn’t optional. Besides these major regulations, there are countless other policies and legal requirements to keep track of. Failing to properly document, assess, and manage compliance risks can have serious financial repercussions and lead to heightened regulatory scrutiny and other legal consequences.

Organizations that don’t have a comprehensive and integrated risk approach often lack the agility and resiience needed to respond quickly to crisis events. Amongst other things, this can lead to supply chain issues, lower productivity, or – in the worst case – severe disruptions to core business processes, which may even put overall business continuity into jeopardy.

by providing training for employees and encouraging them to recognize, report, and help mitigate risks in their daily work.

by defining roles, responsibilities, and structured risk processes for consistency and accountability.

to support growth, stability, and long-term success while strengthening corporate governance and business operations.

by providing stakeholders with accurate, up-to-date risk data for more transparency and better decision-making.

by fostering collaboration between departments and promoting a unified, cross-functional risk approach.

using integrated software solutions to streamline workflows and efficiently manage risks across the organization.

To select the right IRM solution, you’ll have to carefully evaluate how well it aligns with your business needs and integrates with your existing systems. The ideal IRM platform should offer essential GRC features such as risk analysis and treatment, auditing tools, internal control mechanisms, compliance databases, and reporting capabilities. Another key requirement is that it facilitates collaboration across teams and departments, ensuring risk data can be easily shared and mitigation strategies properly aligned.

Additionally, you should ask yourself the following questions:

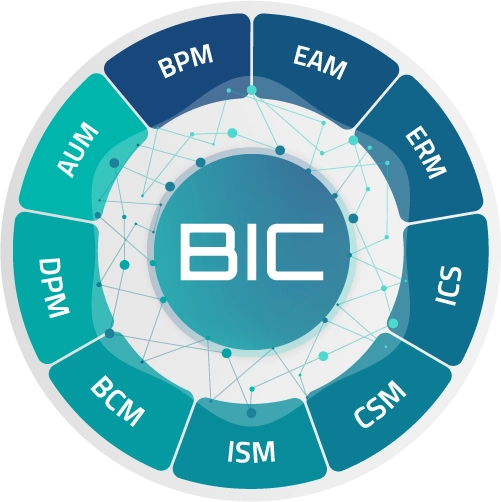

BIC GRC is a single-source platform that brings all your risk management needs together in one powerful solution. It covers all key areas, including enterprise risk, internal controls, information security, compliance, business continuity, auditing, and more. With an intuitive interface, smart automation, and real-time insights, BIC GRC helps you address risks proactively, build resilience, and continuously enhance your GRC maturity.

GRC Solution Architect

Sandra Blaha combines her deep hands-on experience from the auditing world with a strong academic background, including studies in Business Law and Business Administration at the Vienna University of Economics and Business, as well as a master’s degree in Risk and Process Management. Since 2021, Sandra has been applying her diverse expertise as a GRC Solutions Architect at GBTEC, where she plays a key role in developing, customizing, and improving the BIC GRC standard solutions. Her main areas of focus include risk management, internal control systems, sustainability management, and internal auditing.